Don’t ignore that this insider sold some shares in Lux Industries Limited (nse: luxind). We would not blame the shareholders of Lux Industries Limited (nse: luxind) if they were a little concerned that Rohit Poddar, a company member, recently raised around Rs 96 billion through the sale of shares at an average price of Rs 1,871. This reduced his stake by a very significant 100%, which could indicate a strong desire to reallocate capital.

However, you can view our IN luxury industry analysis if you would rather see where the opportunities and threats lie within the LUXIND industry.

Lux Industries’ internal transactions over the past year

According to our records, the recent sale of Rohit Poddar was the largest sale of Lux Industries stock by an insider in the last 12 months. This means that an insider sold shares below the current price (₹1,896). When an insider sells below the current price, he implies that the lower price is fair. We, therefore, wonder what they think of the recent (higher) rating. While insider selling is sometimes discouraging, it’s a weak signal. The largest single sale was Rohit Poddar’s 100 percent ownership.

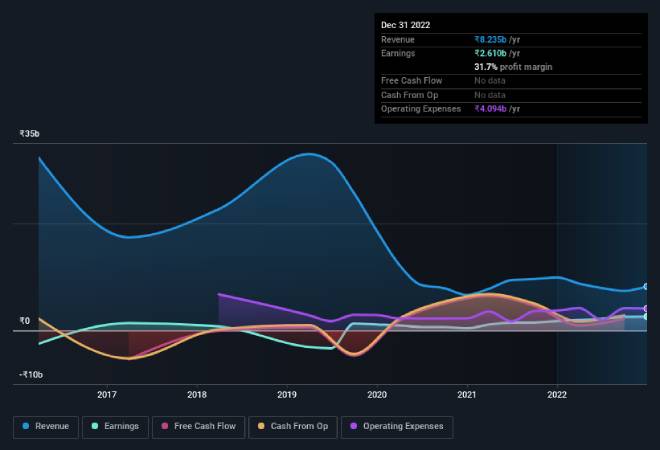

Below is a visual representation of internal transactions (by companies and individuals) for the last 12 months. Click on the graphic below to see the precise definition.

If you’d buy stocks that experts are buying rather than sell them, you’ll love this free list of companies. (Hint: The Experts bought them.)

internal property

I like to look at how many shares insiders own in a company to support my opinion on how well they match insiders. Typically, the larger the insider interest, the more likely insiders will be incentivized to build the company over the long term. nse: luxind Industries insiders own around Rs 39,000 crore shares (68% of the company). I like to see this level of insider ownership because it increases the likelihood that management has the best interests of shareholders in mind.

So what does this data say about the experts at Lux Industries?

An insider recently sold shares in nse: luxind Industries, but they didn’t buy any. And there were no purchases in the last year that gave us comfort. But it’s good to see Lux Industries increasing its profits. It’s nice to see how many insiders own, but insider sales make us suspicious. While we like to know what happens with insider ownership and trading, we also consider the stock’s risks before making investment decisions. Our analysis found that Lux Industries has one warning sign, and it would be unwise to ignore it.

Related Search Terms

NSE:ACC,

NSE: ADANIGREEN,

NSE:ATGL,

NSE: ADANITRANS,

NSE:DMART,

NSE:BANDHANBNK,

NSE: BERGEPAINT,

NSE:BEL,

NSE:BIOCON,

NSE:BOSCHLTD,

NSE: CHOLAFIN,

NSE:COLPAL,

NSE:DLF,

NSE: DABUR,

NSE: NYKAA,

NSE:GAIL,

NSE:GLAND,

NSE:GODREJCP,

NSE:HDFCAMC,

NSE: HAVELLS,

NSE:HAL,

NSE:ICICIGI,

NSE: ICICIPRULI,

NSE:IOC,

NSE:IRCTC,

NSE:INDUSTOWER,

NSE: NAUKRI,

NSE: INDIGO,

NSE:LTI,

[NSE: LICI,]

[NSE: MARICO,]

NSE: MPHASIS,

NSE: MUTHOOTFIN,

NSE:PAYTM,

NSE:PIIND,

NSE: PIDILITIND,

NSE:PGHH,

NSE:SBICARD,

NSE:SRF

[NSE: MOTHERSON]

[NSE: SHREECEM]

[NSE: SIEMENS]

NSE: TATAPOWER

NSE:TORNTPHARM,

NSE:MCDOWELL_N,

NSE:VEDL,

NSE: ZOMATO,